Earnings Wobble, Central Banks Hold Steady | Weekly Recap: 27-31 October 2025

Economic Overview

The final week of October delivered a mix of central bank decisions, earnings results, and macroeconomic data. In the US, the Fed cut interest rates by 25 basis points at its 29-30 October meeting, lowering the target range to 3.75%-4.00%. Powell acknowledged that inflation had eased but remained persistent, and labour market signals were mixed. The Fed maintained a cautious tone, emphasizing uncertainty around future cuts and reiterating its data-dependent stance. Market expectations for a December cut were dialled back, with attention shifting to early 2026.

In Europe, the ECB held its deposit rate steady at 2.00%. President Lagarde noted that inflation was near target but warned of continued weakness in eurozone growth, particularly in Germany. BoJ also kept rates in negative territory, maintaining its ultra-loose policy stance. Inflation in Japan hovered around 2.8%, adding pressure on the BoJ’s forward guidance as the yen continued to weaken.

Fresh data was mixed. In the US, core PCE inflation (the Fed’s preferred measure) came in at 2.7% y/y for September, supporting expectations for gradual easing. Consumer confidence softened slightly, while jobless claims remained stable. In China, manufacturing PMIs stayed in contraction territory, highlighting weak domestic demand and reinforcing expectations for further policy support.

Equities, Bonds & Commodities

Equity markets provided decent gains despite mixed earnings and macro signals. The S&P 500 rose around 0.76%, while the Nasdaq gained 2.32%, supported by strength in tech. A Friday rally helped lift indices into positive territory. In Europe, the STOXX 600 fell 1.6%, dragged down by healthcare and industrials. UK stocks were flat to slightly positive, supported by commodity-linked sectors.

Bond yields drifted lower following central bank meetings. The US 10-year Treasury yield settled near 4.08% by Friday, down from earlier highs around 4.18%. German Bund yields slipped toward 2.48%, and 10-year gilt yields fell to around 4.25%, as BoE expectations shifted more firmly toward cuts in early 2026.

Oil prices moved sideways, constrained by uncertainty around OPEC+ decisions and geopolitical developments. Brent crude traded between $60 and $65 per barrel before ending the week near $60.8. Gold rebounded slightly, climbing toward $4,025/oz as investors sought safety amid market volatility.

Regional Markets

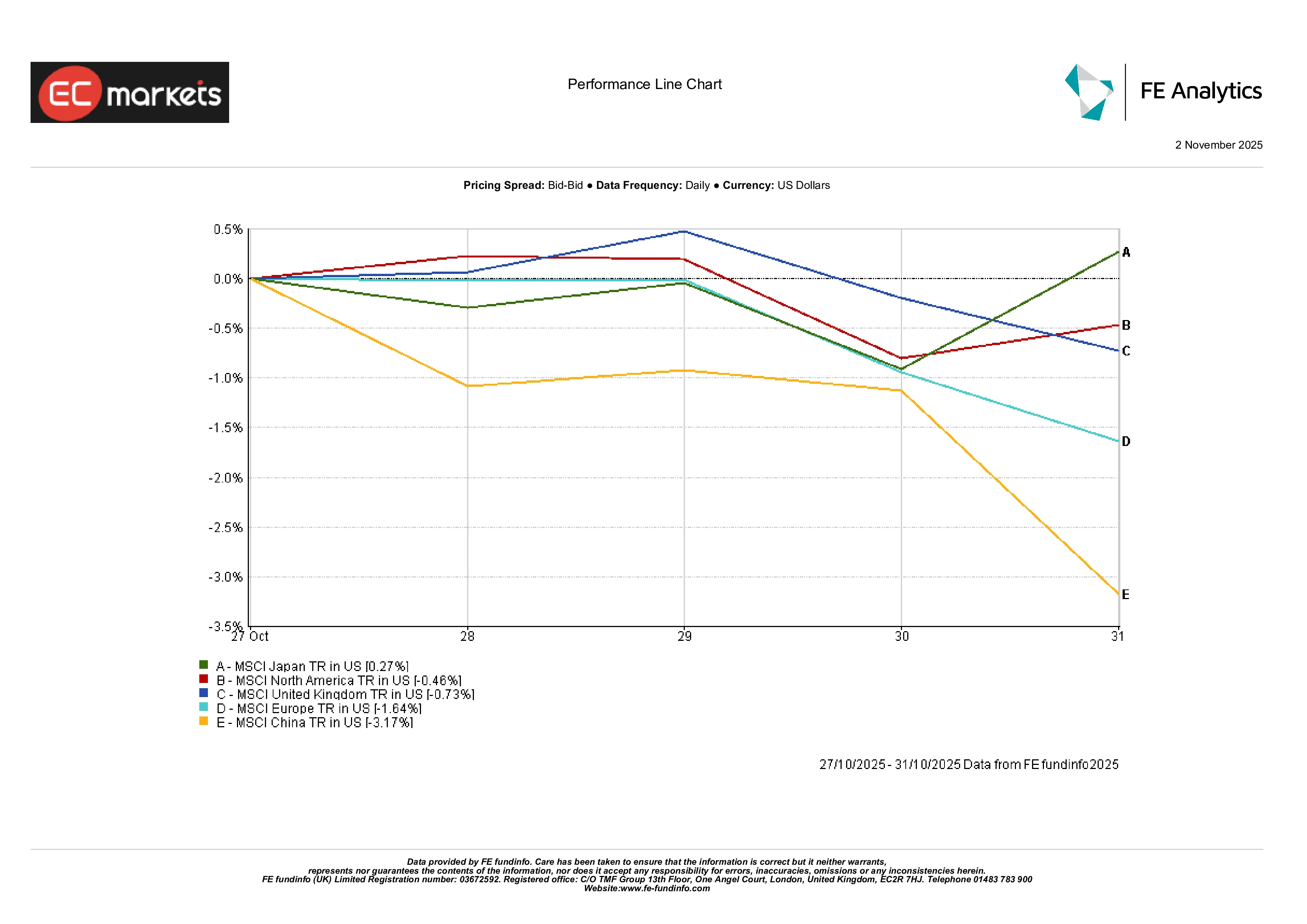

Regional equity performance diverged. The MSCI North America fell 0.5%, despite support from resilient tech earnings. UK stocks (MSCI United Kingdom) were nearly flat, ending the week down 0.7%. MSCI Europe declined more sharply at -1.6%, reflecting persistent growth concerns and earnings disappointments in key sectors.

China underperformed, with MSCI China down 3.2%. Weak PMIs and sluggish credit growth renewed investor concerns about the recovery. Japan saw modest gains: MSCI Japan rose 0.3% as the yen weakened and earnings remained firm.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 31 October 2025.

Sector Performance

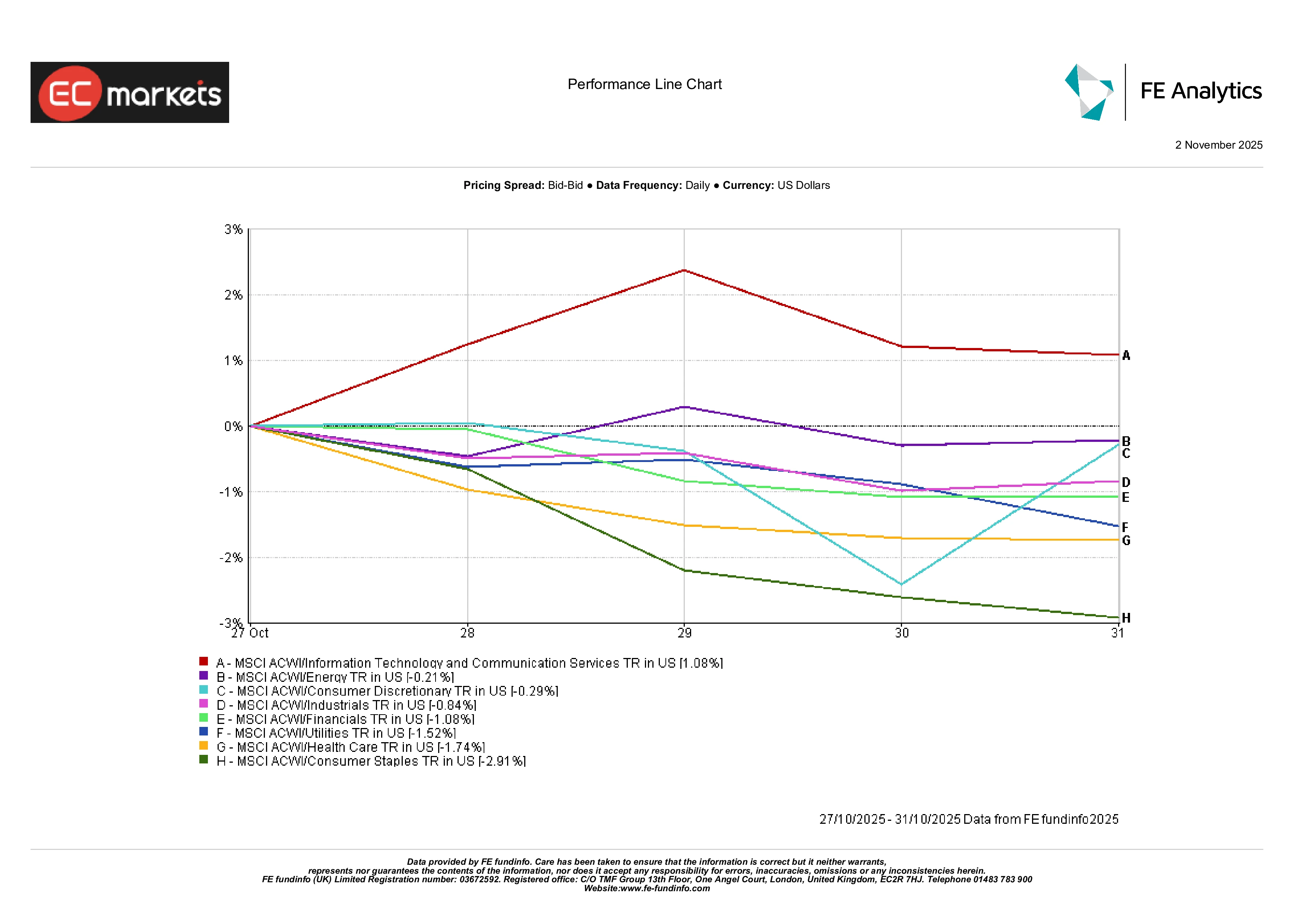

Sector performance was mixed. Technology led gains, supported by strong earnings from software and semiconductor companies. MSCI ACWI Information Technology rose about 1%, outperforming other sectors. Energy was broadly flat (-0.2%) after a strong run in prior weeks. Financials and Industrials fell 1.0% and 0.8%, respectively, in line with broader equity softness. Consumer Staples underperformed sharply, falling nearly -3% after disappointing results from major retailers. Healthcare and Utilities also lagged as investors rotated out of defensives.

Overall, leadership tilted toward growth sectors, while defensives and cyclicals came under pressure.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 17 October 2025.

Currency Markets

FX markets reflected central bank dynamics. Sterling slipped: GBP/USD fell from 1.3337 to 1.3155, down about 1.4% for the week, as BoE commentary leaned dovish. The euro also lost ground, with EUR/USD falling from 1.1652 to 1.1536.

The yen weakened further. USD/JPY rose from 152.88 to 154.01, reflecting divergence between BoJ and Fed outlooks. GBP/JPY also fell, ending the week near 202.60 from 203.88. Overall, moves were orderly and broadly aligned with relative policy expectations.

Outlook & The Week Ahead

Markets enter November with key data and events on the radar. In the US, the jobs report on 8 November will be closely watched for signs of labour market cooling. Other releases include ISM services and factory orders, which may influence the Fed’s near-term tone. Investors will also be monitoring speeches from Fed officials.

In Europe, updates on industrial production and retail sales will offer more insight into the extent of the slowdown. The ECB minutes may provide detail on how policymakers view inflation and balance sheet strategy. The BoE is also due to publish new economic projections.

Asia’s focus will be on China’s trade and credit figures, especially following weak PMI results. Japanese corporates, particularly in autos and semiconductors, will report earnings.

Corporate earnings remain in focus globally, especially in consumer and financial sectors. While October ended on a mixed note, the broader backdrop — easing inflation, central bank caution, and stabilising data, still looks constructive as the year winds down.