Are Small-Cap Stocks Set to Outperform in 2025?

Let’s face it — small caps haven’t had it easy. While mega-cap tech stocks were busy driving the S&P 500 to all-time highs, smaller companies were stuck playing second fiddle. Since 2015, the Russell 2000 (a key benchmark for small cap stocks 2025) has delivered less than half the gains of its large-cap counterpart. That’s a long time to be lagging.

Performance of S&P 500 vs MSCI World Small Cap vs Russell 2000 (2015–2025)

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 June 2025.

And yet… maybe this is exactly why things could turn. Markets move in cycles, and the cycle for small caps? It’s been stretched thinner than usual. Now, in 2025, some fresh tailwinds may finally be lining up.

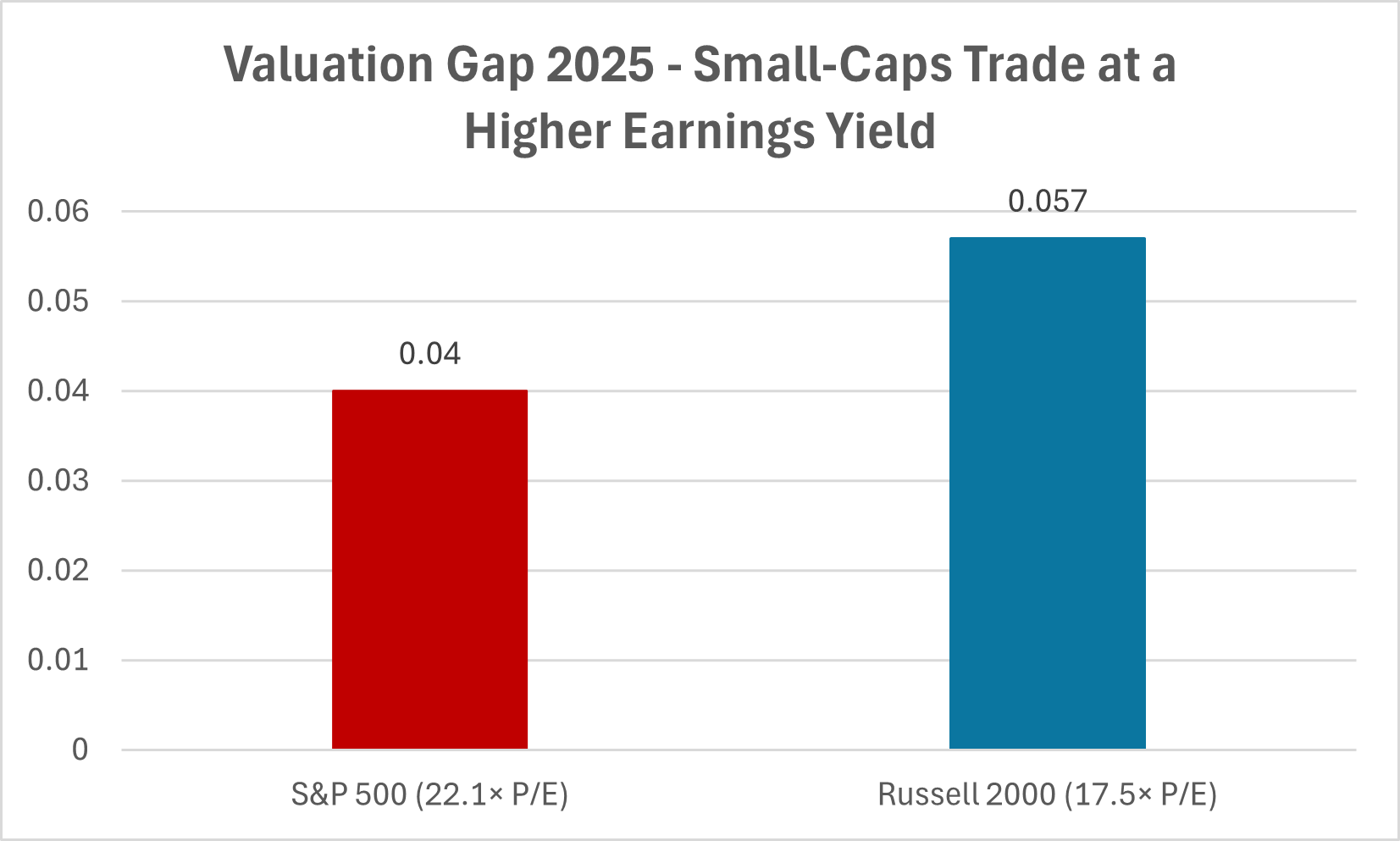

Small-Cap Valuations 2025: The Discount investors can’t ignore

Start with price. The S&P 500 is sitting north of 22× forward earnings. The Russell 2000? 17.52.

Sure, a lot of small-cap names are still unprofitable. That’s baked in. But even if you strip out the loss-makers, the earnings yield (that’s just earnings / price) on small caps looks far more appealing than their larger cousins.

Put bluntly: investors are paying up for the big names and ignoring the little ones. That doesn’t last forever!

Performance of S&P 500 vs MSCI World Small Cap vs Russell 2000 (2015–2025)

Source: Bloomberg, FactSet, S&P Dow Jones Indices, FTSE Russell. Earnings yield = 1 ÷ forward P/E. Figures are rounded to one decimal place. Data as of June 2025.

The Russell 2000 offers a higher earnings yield of 5.7 % compared with the S&P 500’s 4.5 %, reflecting cheaper forward P/E multiples (17.5× vs 22.1×).

Macro Setup: Fed Pivot and Inflation Moderation

According to several forecasts, the backdrop for small cap stocks 2025 looks markedly different from the last few years. After one of the most aggressive tightening cycles in decades, the US Fed finally shifted to a data-driven, easing stance as inflation moderated through 2024. Core CPI fell toward the 2.5-3% range, and real yields began retreating from decade highs. That pivot matters because small caps tend to be highly rate-sensitive. And many of those firms depend on short-term or floating-rate financing.

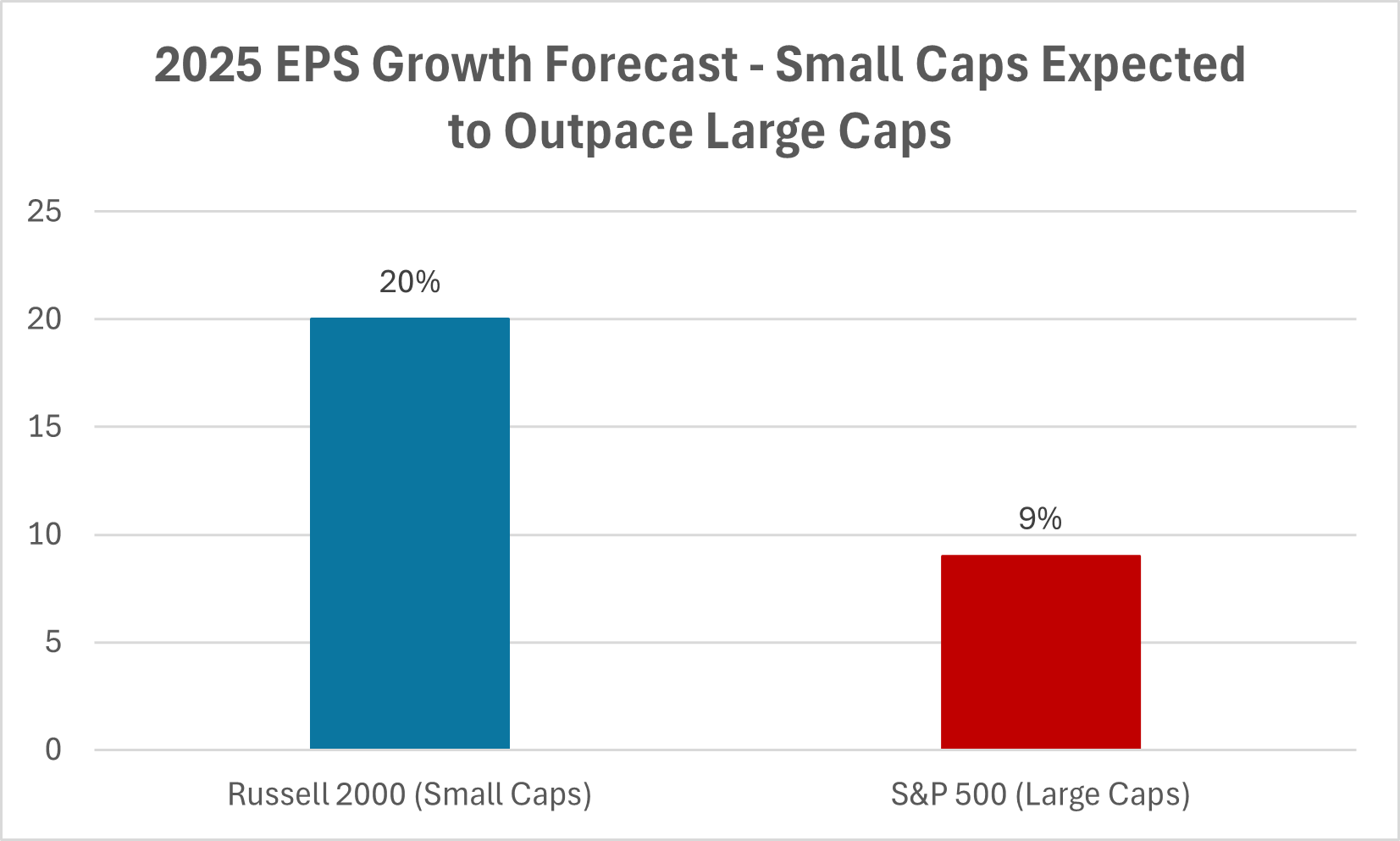

With the Fed now signalling gradual cuts into 2025, the small-cap outlook 2025 is supported by a combination of falling borrowing costs, improving margins, and re-emerging earnings momentum. In fact, analysts expect small-cap EPS growth to outpace the S&P 500 by almost two-to-one if inflation remains contained.

Macro Tailwinds for Small Cap Stocks 2025: Rates, Dollar and Growth

If interest rates fall as expected this year, small caps may feel the boost first. Many rely on floating-rate debt, so even a modest cut can improve margins. It’s one of the clearest arguments for a recovery in this part of the market.

There’s also the currency angle. The US dollar has softened in 2025, which tends to benefit smaller domestic firms more than multinationals. Around 80% of Russell 2000 revenue is earned within the US, so these companies aren’t as exposed to currency swings or geopolitical tension.

Then there’s earnings. Forecasts for small-cap earnings growth in 2025 hover around 20%, well ahead of large caps. If the economy manages a soft landing or stable expansion, these projections could prove conservative.

Earnings Momentum Turning Toward Small Caps

Source: Hartford Funds, J.P. Morgan Asset Management, FactSet. EPS growth forecasts based on consensus estimates for 2025. Figures rounded to the nearest whole number. Data as of September 2025.

Consensus forecasts indicate Russell 2000 earnings could grow around 20 % in 2025, versus about 9 % for the S&P 500, supporting a potential rotation into smaller companies.

Historical Playbook: How Small Caps Behave After Tightening Cycles

History shows that small cap stocks 2025 are entering a familiar phase. After every major Fed tightening cycle, whether in 2003, 2010, or 2020, small caps led markets higher once rate cuts began.

The logic is simple: when credit conditions ease, smaller companies see this as an opportunity as it costs less to borrow the same amount. That same pattern underpins many analyst expectations in the Russell 2000 forecast 2025; that the next leg higher could come from companies that lagged the last bull run.

Historical Small Cap Outperformance After Rate Cuts

| Fed Cycle | First Rate Cut | Small-Cap vs S&P 500 (12 Months) |

| 2003 | Jan-03 | +8-10 ppt |

| 2010 | Dec-08 | +15 ppt |

| 2020 | Mar-20 | +20 ppt |

This cyclical pattern reinforces the broader small-cap outlook 2025 that many strategists believe is still in its early innings.

Russell 2000 Forecast 2025: Which Sectors Could Drive a Rebound?

Small-cap indices lean heavily into cyclical sectors like industrials, financials and healthcare. These areas tend to benefit first when the economy stabilises or reaccelerates. Regional banks, for instance, could see a margin lift as credit conditions ease. Biotech names with real pipelines may get a second look from investors chasing innovation outside Big Tech.

Investor Positioning and ETF Flows: Still Under-Owned

Despite improving fundamentals, investor positioning remains cautious. Data from ETF.com shows that US small-cap ETFs including IWM (iShares Russell 2000) and IJR (S&P Small-Cap 600) have seen around $19 billion in outflows so far in 2025 (as of August 2025). IWM alone shed $10.8 billion, its steepest withdrawal on record. Yet sentiment may be turning. In September, IWM attracted $1.6 billion in a single day, suggesting that investors are slowly rotating back toward this space.

If flows continue reversing alongside rate cuts, the small-cap outlook 2025 could strengthen rapidly, especially as valuations remain attractive relative to large caps.

Risks in the Small-Cap Outlook 2025: Volatility and Credit Conditions

None of this is to say small caps are a sure bet. They remain volatile. They trade on thinner volumes. And when the economy wobbles, they often fall harder than large caps. Even with rate cuts, financing conditions could stay tight, which is a challenge for companies already running lean.

And let’s be honest: investor appetite hasn’t fully returned yet. With capital still flowing into the same familiar large-cap names, it may take a clear catalyst to trigger a full-blown rotation.

Bottom Line: Positioning for a Small-Cap Comeback in 2025

So, are small caps ready to outperform in 2025? The case is building. Valuations are low, growth potential is rising and macro conditions are shifting in their favour. But timing matters. This isn’t about making a big bet; it’s about recognising that cycles turn and this one is due.

For long-term investors, a modest allocation to high-quality small-cap stocks could offer not just diversification, but genuine upside. The road may be bumpier, but for those willing to stomach the swings, 2025 might just be the year small caps step out from the sidelines.

The Russell 2000 forecast 2025 points to improving breadth and that could be where the next leg of equity performance quietly begins