Can Low-Duration Stocks Still Protect You in a Falling Rate Environment?

Central banks are shifting gears. The Fed, ECB, and BoE have all turned more dovish heading into the end of 2025, and rate cuts are now widely expected. Inflation is cooling slowly but steadily, and bond yields are drifting lower. On paper, this should be a sweet spot for low-duration stocks: financials, energy, and defensives that lean on near-term cash flows rather than long-term growth stories.

But here’s the real question: are these “low-duration” names still doing what they’re supposed to? That is offering downside protection and rate sensitivity? Or has the trade already played out?

Are Low-Duration Stocks Still Rate Sensitive?

The logic is familiar: when rates fall, discount rates drop, which boosts the value of cash flows closer to today. That’s supposed to benefit sectors like banks, insurers, utilities, and energy, especially those with solid dividends.

And early in the year, that narrative held up. Financials got a lift as the yield curve started to normalize. Energy bounced back thanks to macro resilience and supply-side support. Even consumer staples saw inflows as recession fears crept in.

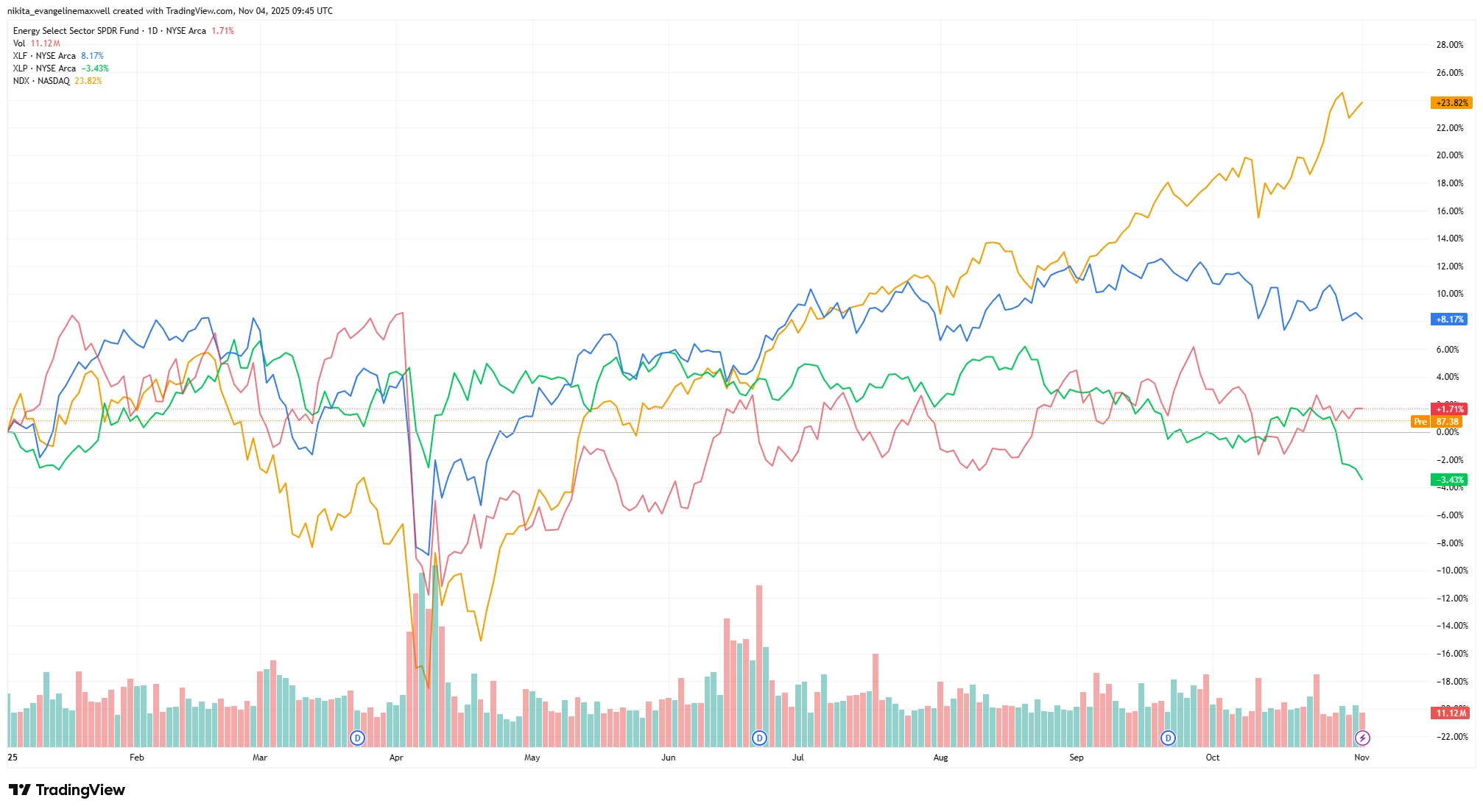

YTD Performance: Low-Duration vs High-Duration Sectors (2025)

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 04 November 2025.

Financials and Energy have posted modest gains, while Consumer Staples slipped into negative territory. In contrast, tech-heavy Nasdaq surged over 24%, highlighting the market’s pivot toward growth.

But fast forward to October, and the momentum has faded. Financials (XLF) are only up around 8% YTD. Energy (XLE) has gained about 1.7%. Dividend ETFs have lagged behind tech-heavy indices. Bank earnings have been okay, not great, with mixed net interest income and rising provisions. Energy companies are still generating cash, but their forward guidance has softened with crude prices swinging around. Staples? They’re steady, but not exciting.

If these stocks are supposed to benefit from falling rates… why aren’t they performing better?

Valuation & Crowding: Is the Trade Too Popular Now?

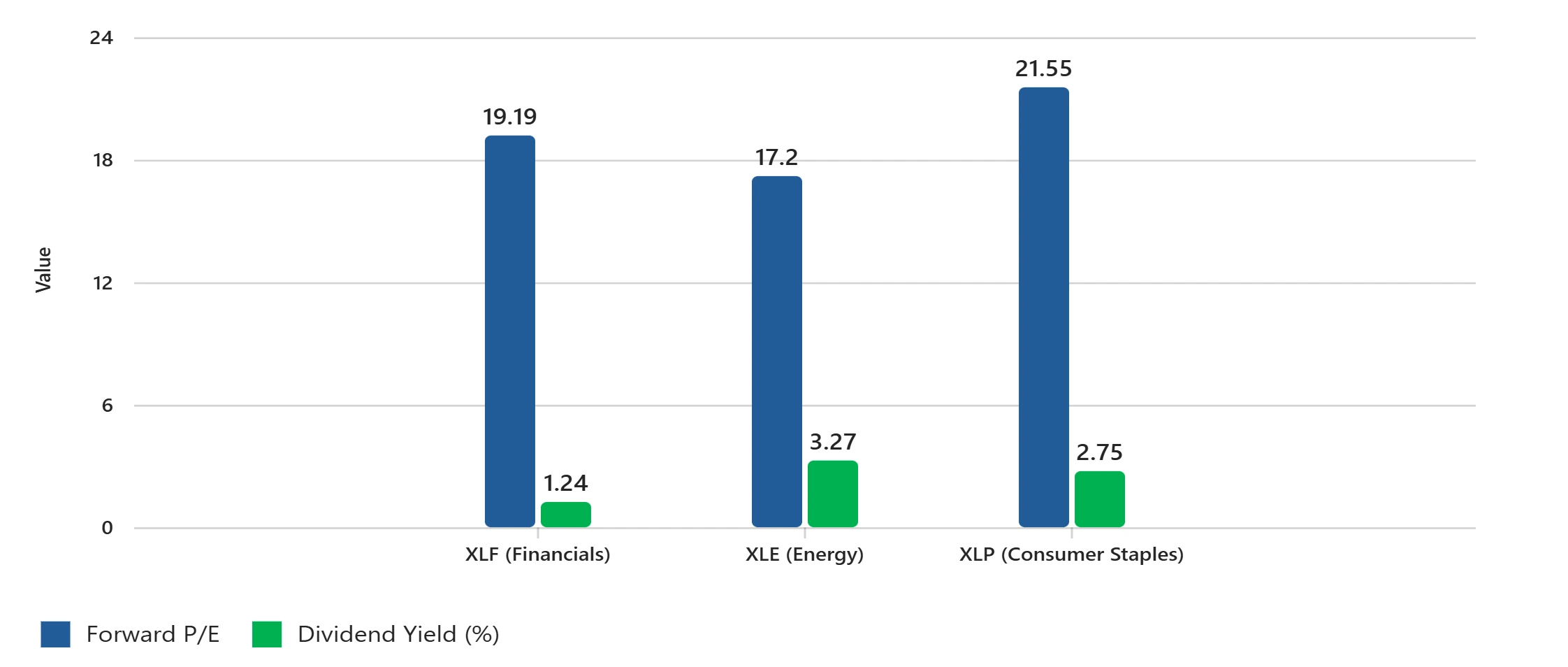

Valuations aren’t exactly cheap anymore. Forward P/Es for financials are hovering around 19×, energy around 17×, and consumer staples are up near 22×, all close to or above their 10-year averages. Dividend yields aren’t as attractive either: XLF is yielding ~1.24%, XLE ~3.27%, and XLP ~2.75%. Meanwhile, the 10-year Treasury is still offering over 4%, which makes those yields less compelling.

Valuation Metrics: Financials, Energy, Consumer Staples

Source: S&P Dow Jones Indices, Select Sector SPDR ETF data. Forward P/E based on sector-level estimates; Dividend Yield reflects 30-day SEC yield. All figures in US dollars. Past performance is not a reliable indicator of future results. Data as of 31 October 2025.

Forward P/E ratios hover near or above historical averages, while dividend yields remain less competitive versus Treasuries.

There’s also the crowding issue. Dividend and value ETFs saw strong inflows in the first half of the year, mostly from institutions chasing yield. But with rate cuts already priced in and cash allocations high, it’s fair to ask: how much upside is left?

Have these stocks become the default “safety” trade? And what happens if inflation picks up again or growth surprises to the upside?

Meanwhile, High-Duration Stocks Are Leading

While low-duration names have stalled, high-duration sectors like tech, consumer discretionary, and parts of healthcare, have taken the lead. AI optimism, strong consumer spending, and solid earnings have pushed the Nasdaq well ahead of value benchmarks.

If falling rates are supposed to help all sectors, why are growth names outperforming? Is the market quietly shifting from defense to offense? Are investors already positioning for a soft landing and the next growth cycle?

Maybe the next wave of outperformance won’t come from “safe” cash-flow generators, but from companies with real secular growth.

Final Thoughts: Is the Safety Trade Already Priced In?

Low-duration stocks still have a place. They offer visibility and yield, which can be valuable when markets get choppy. But with valuations stretched and rate cuts already baked in, the upside might be limited. If growth picks up, these names could lag. If things slow down too much, their cyclical exposure could hurt.

So the real question is: are you buying safety, or paying for a trade that’s already played out?