Defensive Sectors in a Dovish World: Still Overpriced?

The stage is set: inflation is finally cooling toward central-bank targets (US core PCE was ~2.1% in April), and major central banks are talking cuts. The Fed held rates in June 2025 but still pencilled in two quarter-point cuts this year. Traditionally, that environment (still-slow growth, low rates) has favoured defensive sectors like consumer staples and utilities – industries with steady cash flows and yields. But here’s the rub: are those “safe” stocks still worth the rich valuations investors are paying? If bond yields are falling and growth isn’t collapsing, should defensives really demand a premium?

Earnings Resilience vs. Valuation Premium

Defensive companies boast reliable revenues, yes, but the recent data show mixed signals. For Q3 2025, analysts forecast S&P 500 earnings up ~8% year-over-year, led by tech, utilities, materials and financials. And in fact, utilities are expected to be among the fastest growers (and we’ve seen that time and again!). Even in staples, demand for essentials has held up: Procter & Gamble (PG), for example, raised US prices ~2-2.5% on core brands to offset costs, and its revenues beat estimates. Unilever, meanwhile, saw about 3.9% underlying sales growth (pricing +2.4%) as it leaned into higher-margin beauty products.

These firms still enjoy pricing power on essentials or premium niches, which has kept top-line growth modestly positive despite some belt-tightening on discretionary spending.

Higher input costs (e.g. last year’s tariffs) have squeezed margins even after price increases. Unilever is streamlining (cost cuts, non-core sales) to “bolster margins amid weak consumer sentiment.”

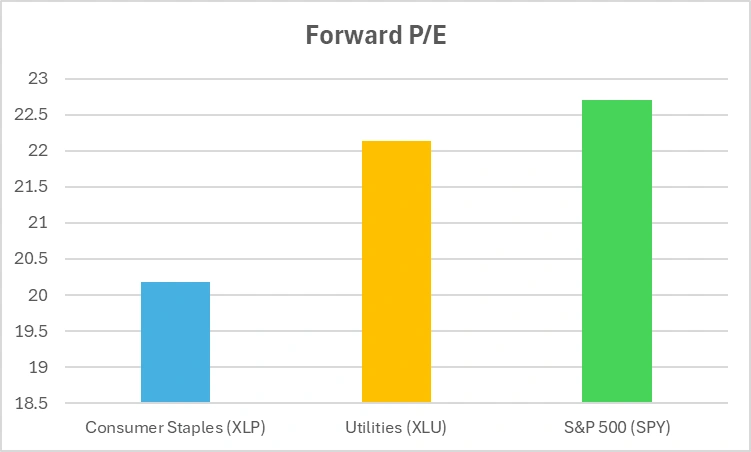

And speaking of valuations: defensives no longer look cheap. The S&P 500’s forward P/E is roughly 22-23×, and staples/utilities trade at similar multiples. Meanwhile, dividend yields in these sectors are only modestly above the broad market. The Consumer Staples ETF (XLP) yields about 2.7% and the Utilities ETF (XLU) around 2.5%, versus a US 10-year Treasury at roughly 4%. Basically, investors are paying the same high price for those modest yields that used to track much higher bond rates.

Valuation Check: Are Defensives Still a Bargain?

*Forward P/E ratios are approximate figures. This chart is for illustrative purposes only.

Valuation check: Defensive sectors now trade at similar forward P/Es as the broader market. Are investors overpaying for perceived stability?

At this stage, staples/utilities aren’t screaming bargain. If slow growth continues to exist, their earnings are steady – but if even modest cost shocks arrive, their margins could slip.

Macro Sensitivity and Market Positioning

Defensive sectors really come into their own when bonds rally or growth stumbles. Utilities in particular are famous “bond proxies”: their regulated profits and high payouts mimic fixed income. In practice, as Treasury yields fell earlier in 2025, US utilities and staples ETFs did outperform. By March, for example, the S&P 500 ETF (SPY) was essentially flat YTD while the Staples ETF (XLP) was up ~4.4% and Utilities (XLU) +3.1% – a clear bond-like shift.

But in a truly dovish cycle, bonds themselves yield less, and the income appeal of stocks can fade. Today a 2.5% dividend vs. a 4% bond looks less compelling than it did when 10-year yields were higher. If rates keep falling, utilities could become even more crowded. That raises a question: if the “bond-proxy” flow is crowded, is there more gas in the tank???

What about positioning? We’ve had more investors allocating cash in staples and utilities as a hedge. That risk-off positioning can become self-reinforcing: heavy funds flows bid up their prices and compress prospective returns. It’s a crowded trade. The lingering question is whether this defensive bulwark will stand if the storm really lifts: are these sectors still acting as stabilizers, or have they just become consensus trades?

YTD 2025: Are Defensives Still Leading?

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 28 October 2025.

Despite a dovish macro backdrop in 2025, defensive sectors have underperformed. Utilities (XLU) and Consumer Staples (XLP) lag well behind the broader S&P 500 (SPY), challenging their safe-haven appeal

Rotation Risk: What If Growth Picks Up?

The flip side is the what if. What if the economy stays strong or even surprises to the upside? If we get a “soft landing” with continued growth and Fed cuts? The outlook shifts, maybe? In that scenario, historically, growth and cyclical sectors often seize the baton.

Imagine a tech-driven rally. If AI and cloud spending stay hot, or if manufacturing and consumer spending hold up, capital could rotate back into growth. That would likely pressure defensive valuations.

Put differently: could defensive stocks turn into value traps if “growth” sneezes and bond yields tumble? When every investor has bought the consensus “safe” trade, the door is shut to new buyers. If risk-on returns, the crowd may rush to exit. That kind of divergence suggests money flowing out of staples into cyclicals. If that rotation accelerates, defensives could lag the broader rally.

Conclusion

Defensive sectors do still offer ballast – predictable cash flows and dividends that seem more attractive as safe policy kicks in. But that protection now comes at a premium. Investors must ask themselves: am I buying true safety, or am I simply buying what everyone else has already agreed is safe? When utilities and staples trade at 20+ P/Es for a 2.5-3% yield, the margin for error is thin. The final question hangs in the air: if “safe” stocks cost as much as this, are they still really safe?