Energy and Earnings Fuel Global Rally | Weekly Recap: 20-24 October 2025

Economic Overview

The week was dominated by political uncertainty and mixed data across economies. In the US, a partial government shutdown dragged on into its third week, delaying many economic releases. Lawmakers hinted at possible resolution, but no breakthrough emerged before the weekend. The shutdown also injected volatility into Fed policy expectations. Markets remain convinced of a 25bp Fed cut at the 29-30 October meeting, but officials have little fresh data to guide them. September’s CPI came out on 24 October (up 0.3% m/m, 3.0% y/y, slightly above forecasts).

In China, Q3 GDP growth slowed to 4.8% y/y, just meeting forecasts. The economy remains weak on the consumer side, with retail sales growth at a 10-month low of +3.0% in September. Elsewhere, Japan reported steady inflation around 2.9%, and its new LDP-led government seemed likely to stay put after party talks.

Global central banks maintained a dovish tilt. In the eurozone, inflation crept up slightly (September CPI ~2.2%) but growth remained sluggish. Economists see no further ECB cuts this year. In the UK, surprisingly steady CPI (3.8% y/y in September) kept BoE officials cautious, and gilt yields fell sharply on rising rate-cut bets.

Equities, Bonds & Commodities

Global stocks generally rose, lifted by resilient corporate news and the prospect of easier monetary policy. In the US, all three major indices closed the week at record highs. The S&P 500 and Nasdaq notched their largest weekly gains since summer, and the Dow had its biggest weekly rise since June. Friday’s downbeat CPI helped cement the rally. In Europe, markets advanced decently: the STOXX Europe 600 rose around 0.4-0.5% for the week, with London’s FTSE 100 up ~0.7% on luxury and energy stock strength. Asian markets were mixed: Hong Kong shares rose on tech rallies, while Japan underperformed (Nikkei down about 1.1% for the week) as the yen weakened.

Bond yields generally eased. In the US, 10-year Treasury yields traded near the 4.0% level; after the CPI release they were about 3.96-4.00%. Shorter-maturity yields also edged down, flattening the curve slightly. In Europe, German bunds rallied: the 10-year Bund yield was about 2.55% by mid-week. In sterling markets, 10-year gilt yields fell sharply into the mid-4% range.

Commodity prices were mixed. Oil prices bounced off five-month lows as traders waited for OPEC+ decisions and digested US-China trade news. Brent crude hovered around $60-65/bbl (settling about $61.3 on 21 October). Gold, which had run up to record highs above $4,300 in early October, pulled back modestly. By week’s end spot gold was trading near $4,100/oz, down from Tuesday’s peak but still on track for a strong yearly gain.

Regional Markets

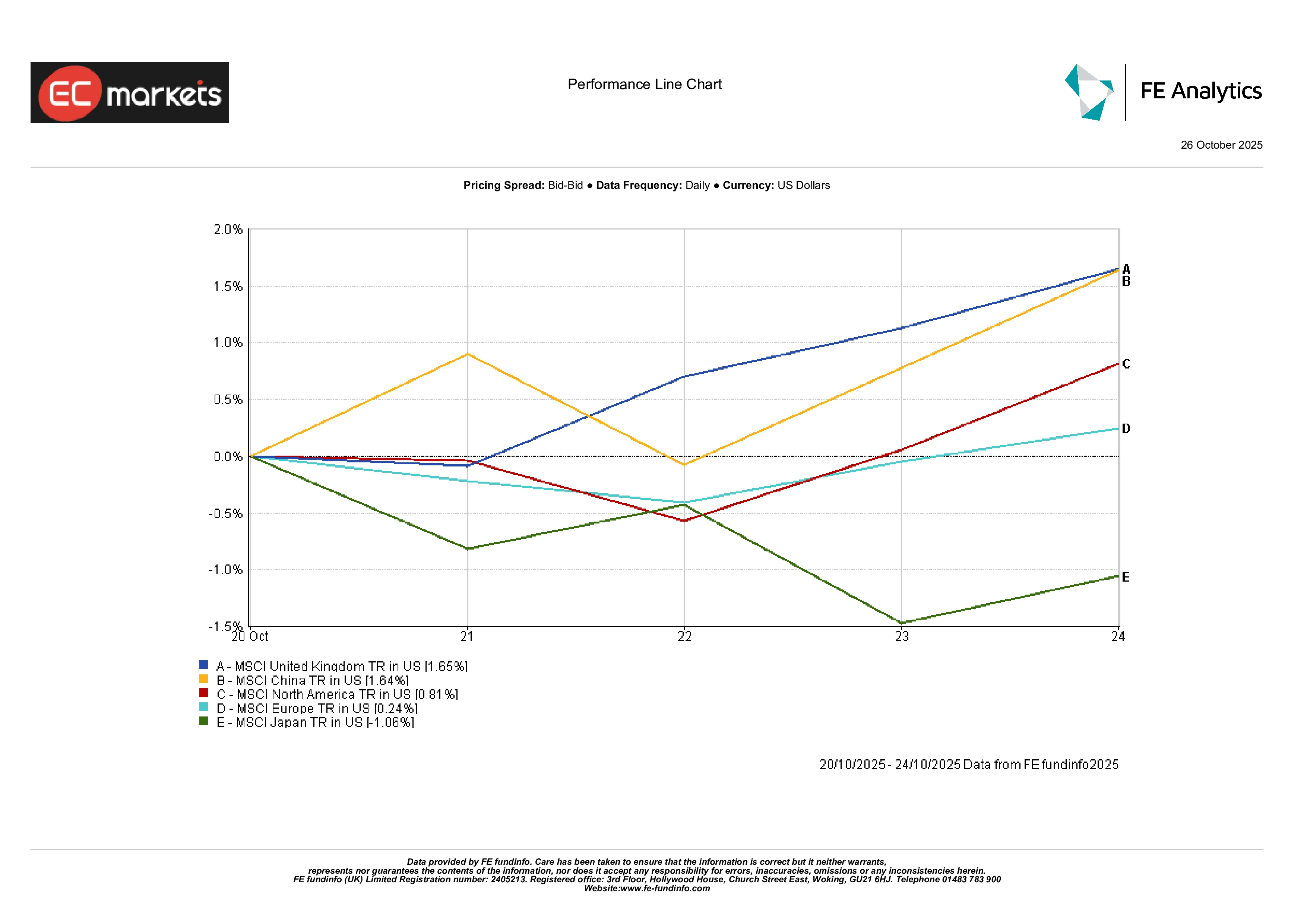

Equity markets diverged somewhat by region. The UK and China were among the week’s top performers: UK stocks gained about +1.6% as commodity exporters and consumer companies rallied. Mainland China equities also rose roughly +1.6%, helped by policy stimulus hopes. North American markets were positive as well, up around +0.8%. Europe ex-UK was essentially flat (around +0.2%) as earnings disappointment in some sectors offset gains. Japan was the laggard, down about -1.1% on the week.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 24 October 2025.

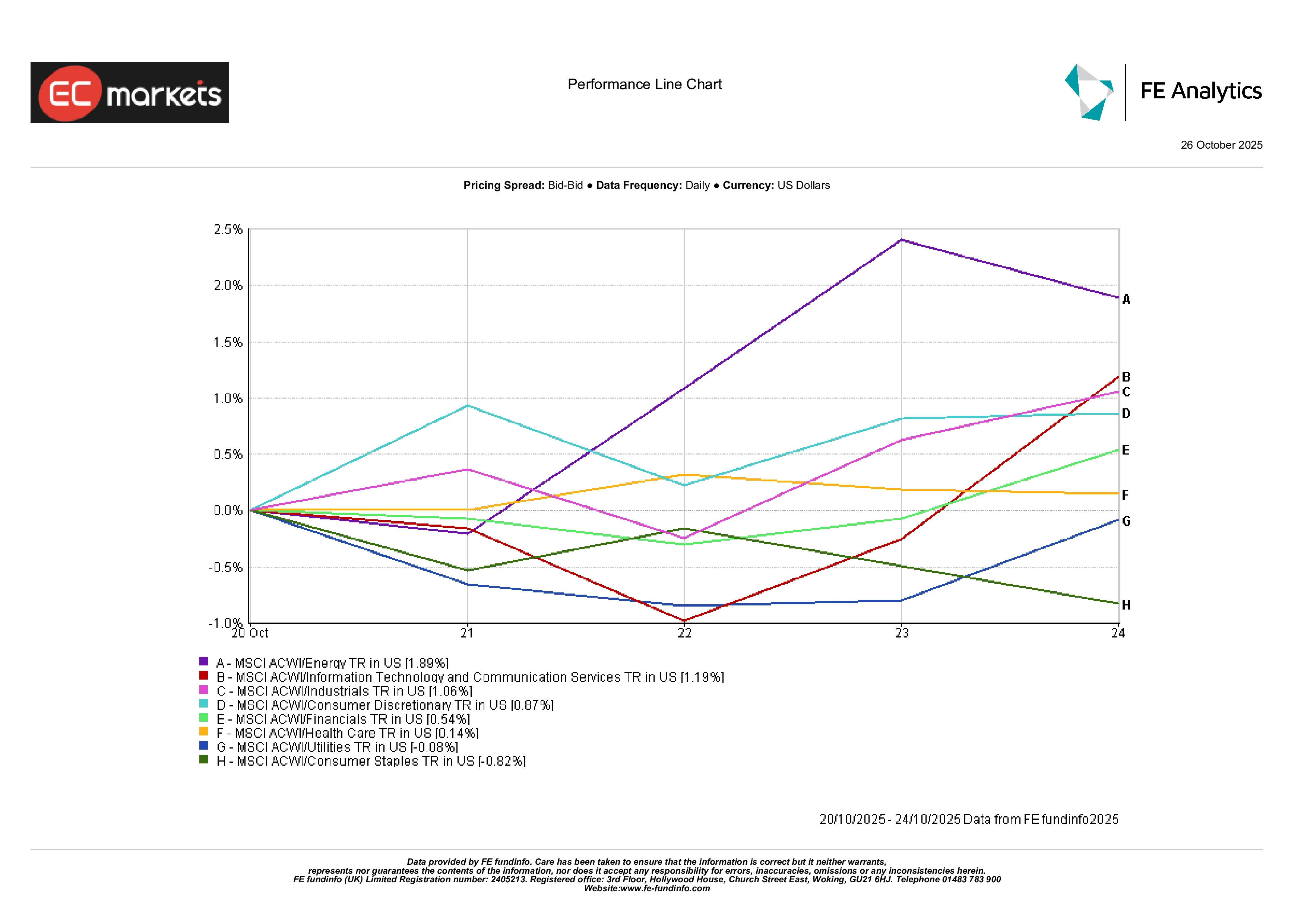

Sector Performance

Sector rotation was evident in the week’s returns. Energy stocks outperformed by a wide margin: MSCI ACWI Energy was up about +1.9%, the biggest sector gain. The rally was driven partly by higher oil prices and sanctions on oil producers. Technology also did well, as AI chipmakers and software firms saw renewed buying ahead of an earnings season that has thus far beaten estimates. By contrast, defensive sectors lagged: Consumer Staples fell roughly -0.8% for the week. Financials and industrials posted modest gains. In summary, cyclicals (energy, industrials, tech) outshone defensives, reflecting an upbeat risk tone.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 17 October 2025.

Currency Markets

In FX, the broad dollar was little changed (DXY stayed near 98.5). Sterling dipped versus the dollar (GBP/USD fell to about 1.331) after UK CPI unexpectedly held at 3.8%, while the euro firmed slightly (EUR/USD rose to ~1.1626). The yen weakened further: USD/JPY was around 152.8 by week’s end, making GBP/JPY roughly 203.5. Overall, currency moves reflected relative rate expectations.

Outlook & The Week Ahead

Looking forward, markets will digest a packed calendar. In the US, final September spending data (core PCE) will be updated, and Fed officials will speak around the 29-30 October FOMC meeting. Most observers expect a 25bp Fed cut, as inflation has cooled and the labour market shows signs of softening. Fed Chair Powell’s post-meeting press conference will also be key.

In Europe, the ECB meets on 30 October; with inflation hovering near 2.2% and growth modest, no policy change is anticipated. Attention will shift to Lagarde’s remarks on how the recent German fiscal expansion might affect inflation late next year.

In Asia, China is set to release end-October activity data: manufacturing and services PMIs are due 1 November. Any signs of further weakness in domestic demand would heighten calls for stimulus. Elsewhere, Japan’s new government and BoJ will be watched closely.

Finally, commodities will face headlines. The US-China trade talks this week in South Korea could influence markets, as could an OPEC+ meeting and global inventory reports. In short, the coming week offers numerous catalysts – but with earnings still strong and policymakers dovish, the backdrop for risk assets remains supportive going into November.